Looking for ESG & Impact Investing Statistics?

We have built a free, comprehensive, and continuously updated statistics portal for journalists, investors, and others want information about the ESG and impact investing markets.

Last update: Q4 2021 (January 2022)

Next update: Q1 2022 (April 2022)

Sustainable & ESG Statistics

Learn about ESG market size, ESG growth rates, and other data points.

-

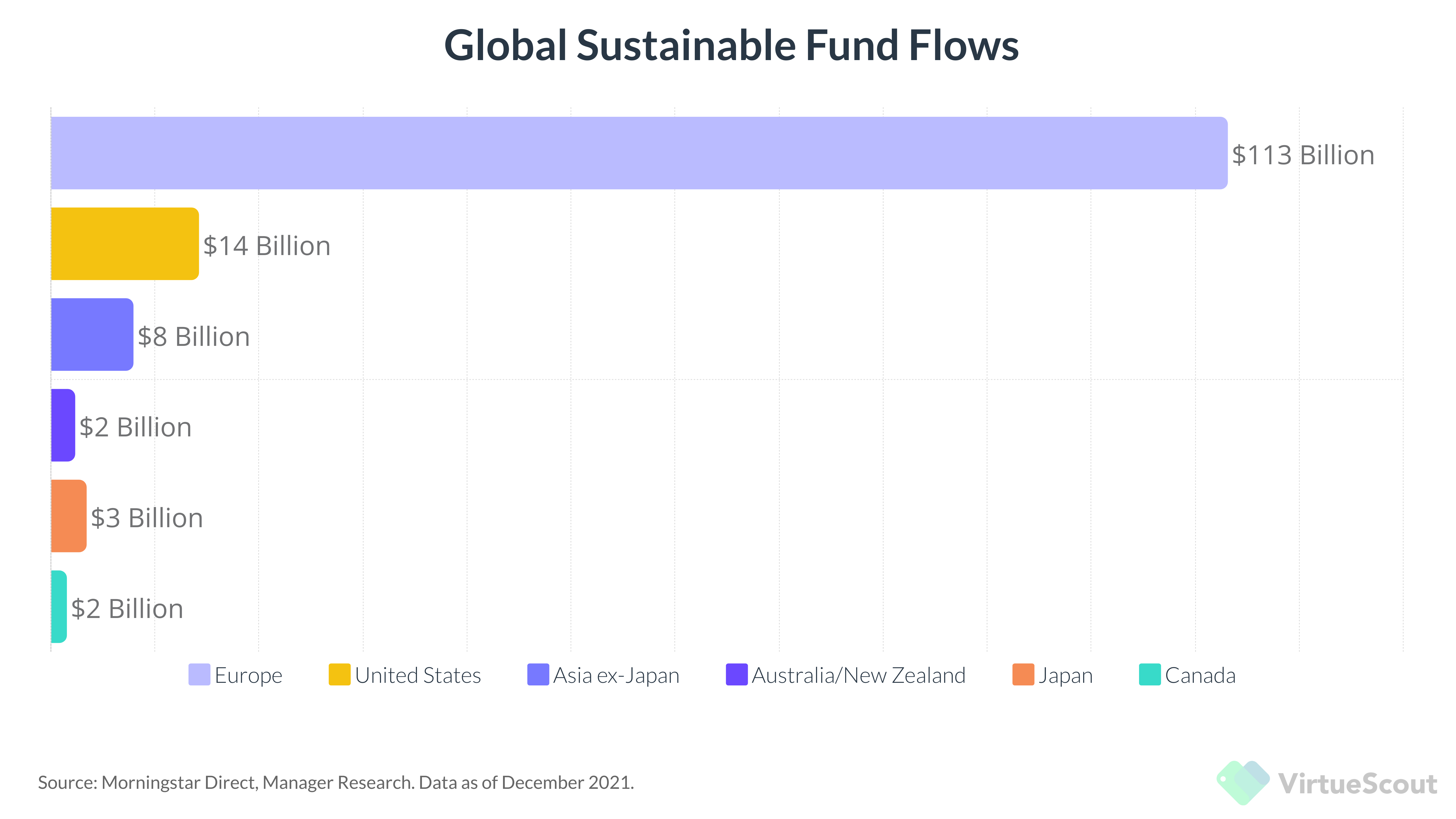

Global sustainable fund assets reached $2.74 trillion in Q4 2021.

- Global sustainable fund assets grew by 9% in the fourth quarter of 2021 to $2.74 trillion, according to Morningstar, as investors poured in $142 billion into sustainable funds globally, representing a 12% increase relative to the third quarter.

-

ESG fund assets reached $357 billion in the United States.

- Sustainable fund assets grew 13% year over year to $357.1 billion in the U.S., according to Morningstar, with the number of funds rising 9% year over year to 534 sustainable funds.

-

More than 260 new ESG or sustainable funds launched during the fourth quarter of 2021.

- ESG product development remains robust with the launch of 266 new sustainable funds during the fourth quarter of 2021, according to Morningstar. Asset managers are also repurposing and rebranding conventional offerings into ESG funds.

Sharable Graphs & Charts

Use our graphics and charts free of charge with attribution.

Impact Investing Statistics

Learn about the size of the impact investing market and how quickly it's growing.

-

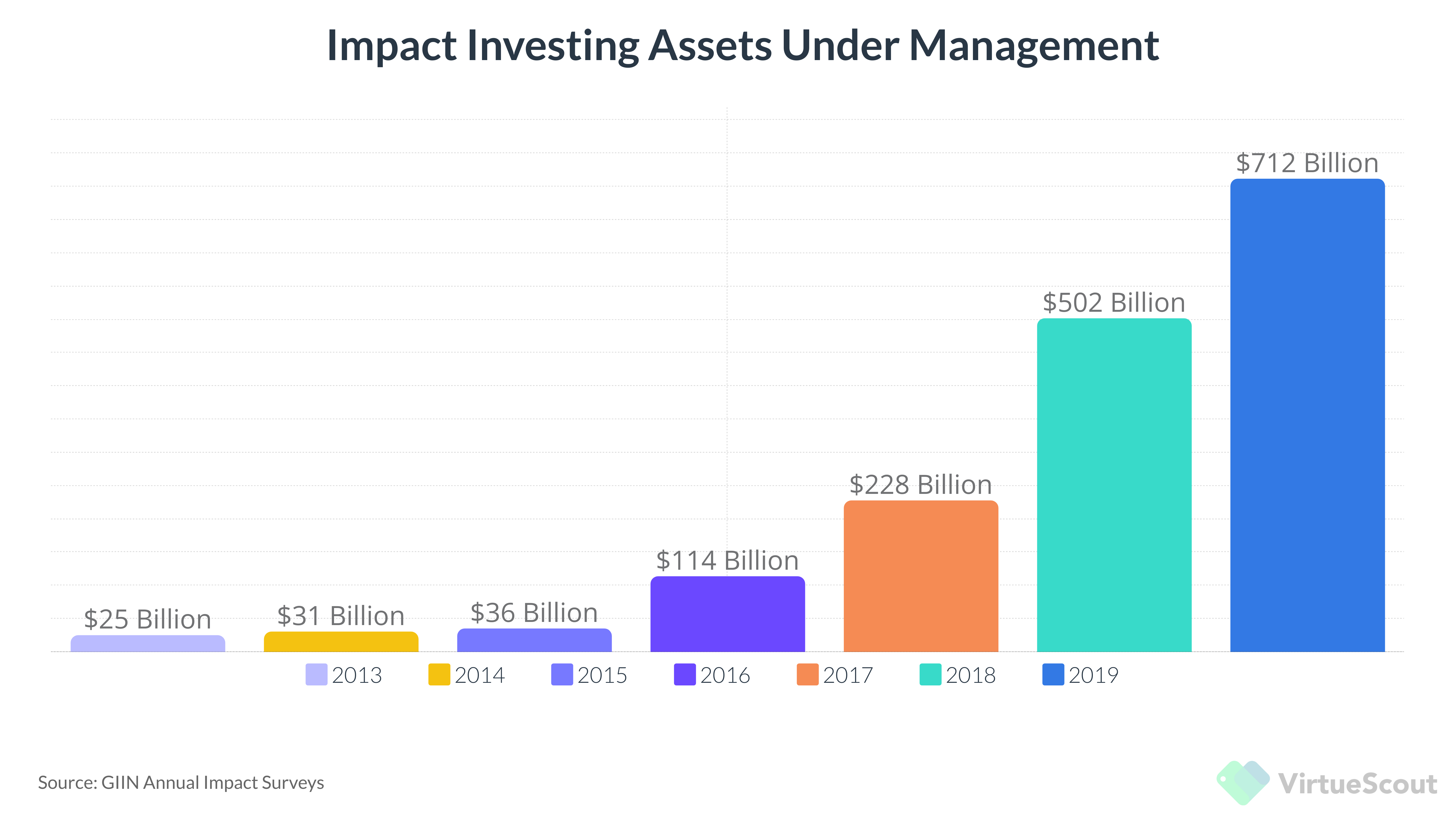

Global impact investment assets reached $715 billion in 2020.

- The GIIN estimates that there are over 1,720 organizations managing $715 billion in impact investments in 2020.

-

Nearly three-quarters of impact managers seek risk-adjusted market-rate returns.

- The GIIN estimates that impact investors have diverse financial return expectations with 67% seeking risk-adjusted market-rate returns, 18% seeking below-market returns close to the market rate, and 15% seeking below market returns closer to capital preservation.

-

Just over three-quarters of impact managers invest directly into companies, projects, and real assets.

- The GIIN estimates that 76% of its sample directly invest into companies, projects and real assests, whereas 24% invest indirectly through intermediaries, such as fund managers.

Sharable Graphs & Charts

Use our graphics and charts free of charge with attribution.