Investing in a Sustainable World: How You Can Make a Difference

Written by

Justin Kuepper

Published on

Feb 10, 2022

Last updated

Feb 13, 2022

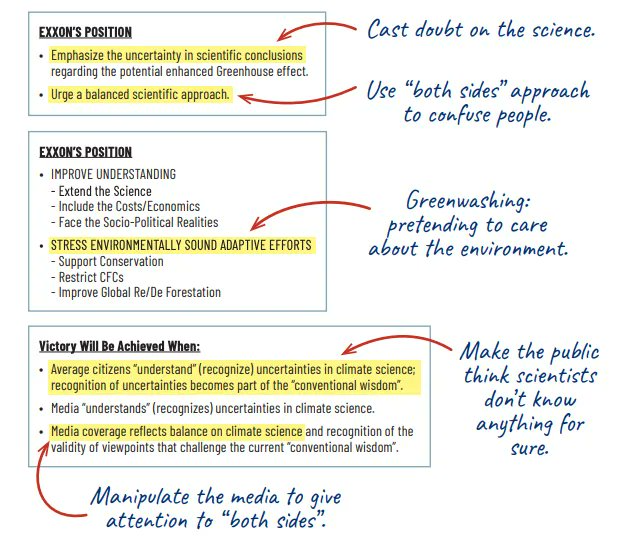

Most people want to make a positive difference in the world, but it's hard to know where to start. While ESG investing has become increasingly popular, so has the practice of "greenwashing," where fund managers use terms like "sustainable," "green," or "ESG" while investing in decidedly non-sustainable companies, like Exxon Mobil.

Let's take a look at investing in a sustainable world and how you can align your portfolio with your values.

Why You Should Invest in a Sustainable World

Human activity is producing greenhouse gas emissions at a record high with no sign of slowing down. Despite promises made by governments, a ten-year summary of the UNEP Emissions Gap reports that we are on track to maintain a "business as usual" trajectory. And the effects of doing nothing are becoming more apparent each year.

Businesses and institutional investors are notoriously slow to change their ways. In addition, many companies would prefer to hide the problem rather than address it. For example, did you know that the four biggest banks in America lend more than $210 billion of their customers' deposits to fossil fuel projects each year?

Exxon Mobil's strategy to lobby against climate action.

Despite these challenges, consumers have extraordinary power to effect change. Americans have nearly $10 trillion in aggregate savings and $35 trillion in retirement assets. Instead of shoveling that money into low-cost index funds, diverting even a portion of it to sustainable banks or sustainable funds can significantly move the needle.

Why Impact Investing > ESG Investments

Environmental, social, and governance (ESG) investing has become a hot commodity on Wall Street. According to iShares, a leading asset manager, ESG assets could reach $1 trillion by 2030. While that's just a fraction of the $118 trillion global capital markets, it's a significant improvement from nearly nothing just a decade ago.

There are two problems with ESG investments:

- There are no clear, universal standards that define what ESG means. As a result, fund managers are free to invent their own, and you may not be investing in a more sustainable world.

- Most ESG investments deploy your investments into companies that meet minimum standards rather than funding projects that impact sustainability—such as a solar farm or reforestation.

Traditional investing to philanthropy spectrum. Source: Activate Your Money

Impact investing refers to the latter type of investments that directly fund renewable energy, sustainable agriculture, or other projects. As a result, if you want to invest in a more sustainable world, you should be looking for impact investments rather than ESG investments to maximize your impact over the long run.

There are several types of impact investments to consider:

- Green Bonds - Green bonds directly finance sustainability-focused projects rather than lending to companies on the whole. The easiest way to invest in green bonds is using Green Bond ETFs, like the VanEck Vectors Green Bond ETF (NYSE: GRNB).

- Sustainable Equities - Many public companies actively invest in renewable energy projects, such as Hannon Armstrong (NYSE: HASI). At the same time, other ETFs take innovative approaches to affect change, such as the Transform 500 ETF (NYSE: VOTE).

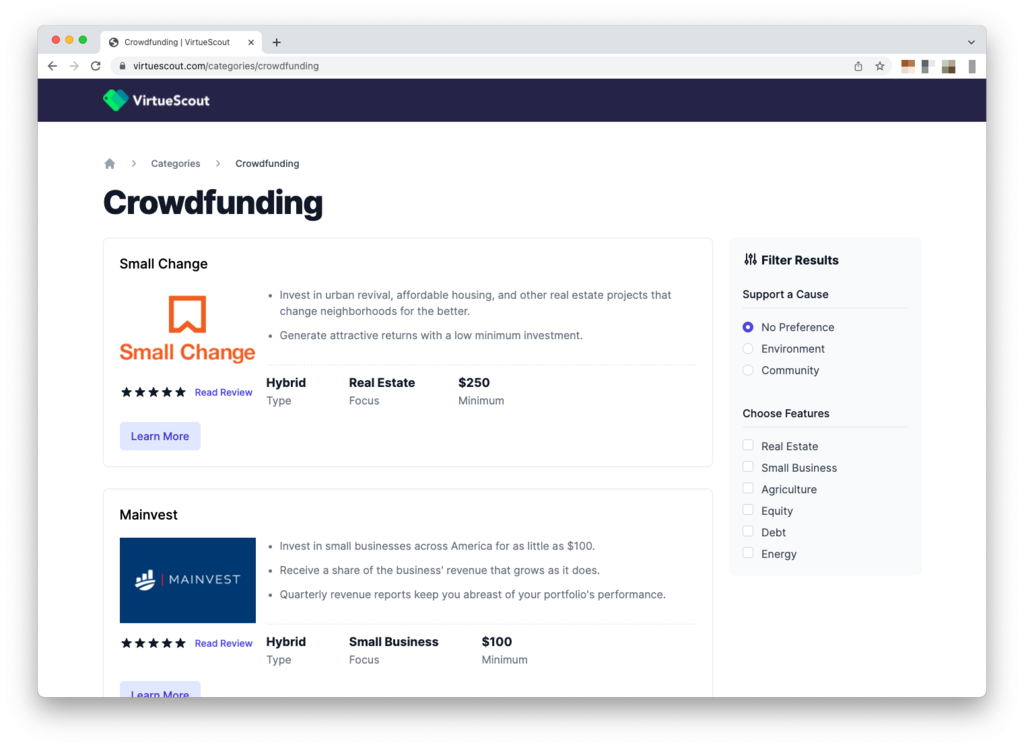

- Crowdfunding Opportunities - A growing number of equity and debt crowdfunding platforms make it easy to invest in renewable energy projects, including Renewables and Energea. These funds make it easy to diversify and potentially realize higher returns.

In the past, many impact investments involved a trade-off where investors had to sacrifice financial returns to make a difference. These days, many impact investments offer a competitive financial return that meets or exceeds their non-sustainable peers. And the rise of impact funds has made them more accessible to everyday investors.

Looking Beyond Your Portfolio

Impact investing is an excellent way to put your portfolio to work for good, but it's not the only way to invest in a more sustainable world. You can also put your checking, savings, and credit cards to work for a good cause by seeking out sustainable banks. And, over the past few years, there has been an explosion of new options!

VirtueScout makes it easy to find opportunities to make a difference.

For example, Atmos and Ando are two neobanks that help put your deposits to work for good. Rather than indiscriminately loaning out your deposits, these companies invest them in sustainability-focused projects and let you measure your impact over time. Meanwhile, the Aspiration Zero credit card plants trees to offset your carbon footprint.

If you have long-term savings or CDs, several impact notes provide an alternative to invest in sustainability. For instance, the Calvert Impact Note supports environmental sustainability and a host of other impact causes. You can also use some of the crowdfunding platforms mentioned above to deploy your long-term savings for good.

Finally, you may want to consider using donations to support organizations creating a more sustainable world. Atmos makes it easy to round up your purchases to support sustainable charities—and it unlocks a 0.4% higher APY on your savings! You can also consider using donor-advised funds (DAFs) to create a holistic way to support sustainability.

How to Get Started Today

Switching a retirement portfolio or opening a new bank account can seem like a daunting task. Rather than trying to do everything at once, try making small changes that add up over time. For example, you can start by opening a new bank account that takes a few minutes and fund it with your emergency savings before making bigger money moves.

Here are some ideas to get started:

- Open an Atmos or Ando bank account and transfer your savings there while keeping your checking at your normal bank.

- Divert just $100 of your regular retirement savings into a sustainability-focused crowdfunding platform, like Energea or Renewables, each month and watch it add up over time.

- Open a new sustainable credit card to use for gas purchases.

VirtueScout is a non-profit organization dedicated to aggregating financial products and services that positively impact the world. We make it easy for you to find checking and savings accounts, investments, advisors, and other financial services and provide unbiased reviews to help you decide on the best option. Get started now—no signups needed!

The Bottom Line

There are many ways to invest in a more sustainable world, ranging from climate banks to crowdfunding renewable energy projects. With trillions of dollars in spending power, transferring just a fraction of our overall net worth toward these projects can enormously impact the environment and ultimately create a more sustainable world.

If you're interested in finding the latest high-impact projects that we find interesting, sign up for our newsletter!